ETFs are the future of investing — leaving basic index funds in the dust. These aren’t just keeping pace with the market; they’re delivering consistent, long-term outperformance powered by sectors with real growth momentum.

Invesco QQQ Trust (QQQ)

What it is: Tracks the Nasdaq-100, giving you exposure to the biggest tech names like Apple, Microsoft, Nvidia

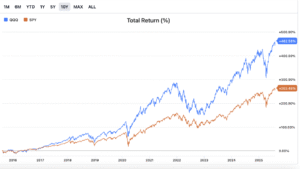

5-Year Return: ~110% vs. S&P 500’s ~80%

Why I like it: Steady tech-driven growth that wins in most situations.

Why Invesco QQQ is better than other ETF’s?

This ETF spreads risk across multiple giants instead of betting on one sector. Also what i like is that tech and innovation have been the biggest contributors to market growth over the last decade, and QQQ is heavily weighted toward both. I like QQQ because it’s the easiest way to own the world’s most innovative companies without having to pick winners myself. It’s tech-heavy, but not reckless!