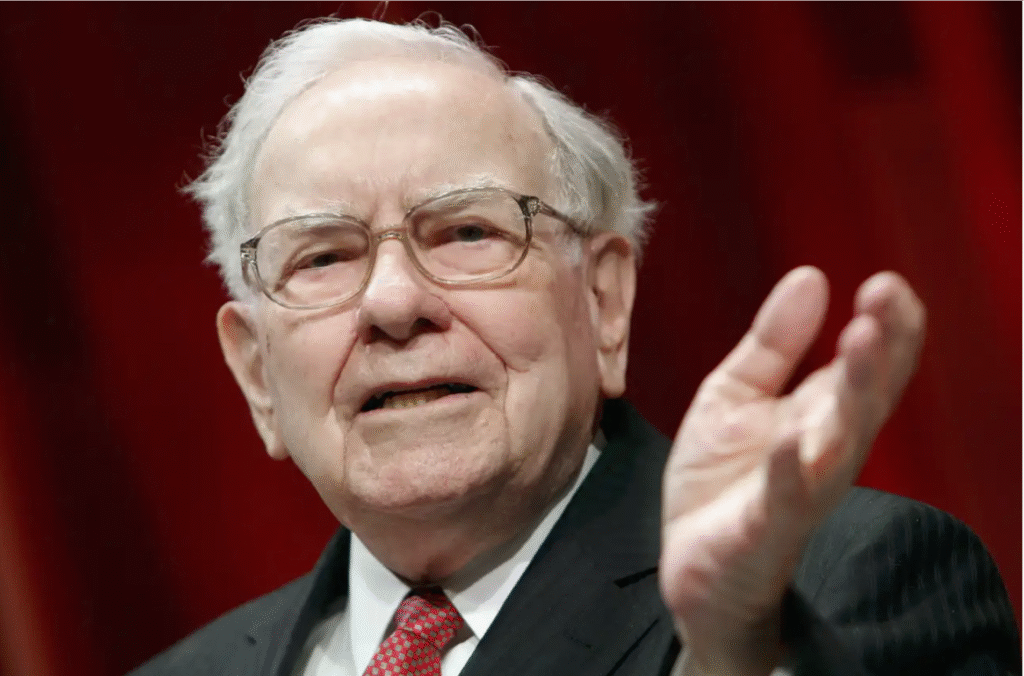

After years of speculation, Berkshire Hathaway confirmed at the end of 2025 that Greg Abel will succeed Warren Buffett as CEO. The transition, once described as “eventual,” now has real weight — and Wall Street is watching closely.

BRK.A (Berkshire Hathaway Class A) stock hit an all-time high above $812,855.00 earlier this year, buoyed by Buffett’s final shareholder letter and the company’s $167B war chest. But the handoff to Abel marks a defining shift. Can he preserve the culture and performance that made Berkshire one of the greatest compounders in history?

Apple (25.8%), American Express (15.8%), Coca-Cola (11.1%), Bank of America (10.2%), Chevron (7.7%), and more

-

Apple alone makes up 25.8% of Berkshire’s public equity portfolio

-

Top 5 holdings (Apple, AmEx, Coca-Cola, BofA, Chevron) = ~70.6% of the total

Buffett has been saving more and more cash lately, clearly getting the company ready for Abel to spend. It’s clear: the future is Abel’s, and he’ll have the money to lead it. Personally, I think Greg Abel is ready for this job. He understands how Berkshire works and won’t take risky bets. With $334 billion in cash, his first big moves could shape the future of the company — and maybe even the U.S. economy. And while no one can replace Warren Buffett, the legend he built is now in trusted hands.