Markets have taken a noticeable hit over the past week, due to a surge in global uncertainty. Escalating conflict in the Middle East has raised serious concerns over oil supply and regional stability. To add on political developments in the U.S. are adding fuel to investor anxiety. With tensions rising on multiple fronts, the market is reflecting it.

But in times like this, certain sectors tend to perform well—especially oil and defense. I’ve mentioned ExxonMobil (XOM) and Chevron (CVX) before, but I’m fully honed in on them now as oil prices continue to climb on supply concerns. On the defense side, Lockheed Martin (LMT) remains a top pick as global spending on security increases.

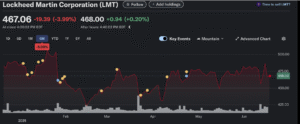

Lockhead Martin Corporation (LMT) Stock Price Trends

A future name to watch is Anduril Industries, a defense-tech startup expected to IPO in late 2025. It’s gaining attention for its work in autonomous military systems and AI-driven surveillance tools. A future name to watch is Anduril Industries, an advanced defense‑tech startup expected to IPO in late 2025. Known for its AI‑powered surveillance tools, media attention, and serious backing from the U.S. military: Anduril is gaining rapid momentum for early‑stage exposure, you can gain pre‑IPO access by investing through platforms like the Fundrise Innovation Fund, which lists Anduril as one of its key private holdings. Heads up this approach is risky and may be volatile.

Are you getting in early, or watching from the sidelines?