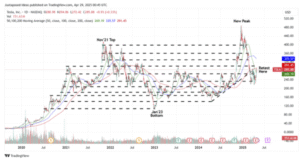

Recently, a company insider allegedly revealed that the board was considering appointing a new CEO amid a period of turmoil. However, the board has denied all such rumors. Tesla (TSLA) spiked post-Trump win, hitting a new peak above $480. But momentum faded fast. Stock plunged below $250 amid weak demand, production issues, and Musk’s focus on DOGE.

Despite a slight rebound to ~$290, the stock sits on shaky ground. Europe is signaling a demand crisis:

-

France sales down 59% YoY — lowest in 2 years

-

Europe-wide Tesla deliveries fell 37% in Q1

Elon Musk says he’s focusing more on Tesla and stepping back from distractions like Dogecoin, DOGE, and GrokAi but analysts aren’t fully convinced. Some have downgraded the stock, saying the recent price jump is just hype — though the latest earnings did show some progress in energy and production.

BYD faces heavy restrictions in the U.S. market due to tariffs and political pushback, limiting its direct competition with Tesla on American soil. Globally, however, BYD is rapidly gaining ground, outselling Tesla in key regions like China and Europe with lower-cost EVs and stronger demand.

Personally, I believe that with the U.S. imposing restrictions on BYD and China fully backing the company, BYD has the potential to seriously disrupt Tesla and challenge its reign as the standard in electric vehicles. Unless Elon Musk refocuses on the company, rebuilds customer loyalty, and rises to the challenge, the outlook doesn’t look promising.

Tesla is at a crossroads — with pressure mounting on Elon, global competition heating up, and investors split between hype and hard reality.